3 Trends that will Reshape Channel Rebate Programs in 2022

Channel partner rebate programs represent a massive, effective program for tech companies. Putting it into perspective, out of the $69B in channel management budgets, 80% (or $55B) is marked out for rebates. Implementing a robust rebate program is the long-term solution that will lock in your partners’ loyalty and prevent competitors from stealing your channel share. But these programs need to be aligned with the ‘new normal’.

Despite being monumental in driving channel growth, too many rebate programs live on spreadsheets or outdated custom systems. Commercial out-of-the-box (OOTB) systems represent the optimal means to:

- automate program tracking

- provide a singular source of transactional rebate data to stakeholders

- enable channel partners to access cloud-managed rebate services

But more on that later.

In this post, let’s discuss the evolution of channel rebate management over the years leading up to the top 3 trends that will shape channel rebate management in 2022.

Rebate management over the years

Channel sales in the 21st century is built on the pillars of rebates and incentives. Non-taxability and direct payment without external or governmental interventions has made them an attractive reward mechanism for tech companies, manufacturers, and distributors to steal market share from their competitors.

The advent of the internet, coupled with access to limitless information, has laid the grounds for a forum to critique rebates as a great incentive for channel partners. But unfortunately, in the last 20 years, there has been little to no innovation in tech companies’ rebate programs. As a result, rebates have become a standard transactional expectation for every sale made. No goals, no conditions, no prerequisites. Partner makes a sale, gets a rebate. Rebates are no longer seen as incentives by channel partners. They have become expected ‘rights’ of resellers, dealers, and MSPs.

3 major trends in rebate management in 2022

Along with the evolution in sales and distribution methodologies in the recent past, rebate programs are also evolving. The redefining of supply chains has incited companies to become more resilient and robust vis-a-vis channel incentives.

Now, as we move towards 2022, let’s look at the three emerging trends dictating channel incentives and rebates.

RIP spreadsheets

As Atlas was condemned to hold up the heavens for eternity, spreadsheets have been burdened to attempt to support:

- multiple and sophisticated rebate deal types

- varied conditional rebates for different types of vendors

- missing data

- dynamic trade agreements

- tight margins

… which makes managing channel rebates on a spreadsheet challenging, to put it mildly. Thus, many rebate programs go stale, even before peaking.

The many permutations defeat the purpose of these programs. For example, multifaceted and diverse rebates, numerous reseller and distributor profiles, and sophisticated frequency rules in rebate disbursements add to the spreadsheet complexity and channel partners’ confusion. This confusion demotivates channel partners to maintain their sales momentum. And so, it is safe to say that ‘Spreadsheets Are Dead!’

The rise of supply chain incentives

Supply chains can be fragile. More so, when they face challenges like disruption, short product life cycles, and disasters. Companies cannot respond to such challenges in silos. They need to work in harmony with their supply chain partners and stakeholders to deal with these challenges. Creating and nurturing alliances with these partners warrant incentives along the lines of ‘reverse rebates’.

‘Reverse rebates’ are cash rewards rewarded in proportion with the degree of organization of these supply chains. The more organized the supply chain, the higher the rebate or cash.

These ‘reverse rebates’ will reshape the concept of rebate to include upstream supply chain partners in the same way traditional rebates have been applied to the downstream channel partners for years.

Implementing this system will support tightly knit workflows between suppliers, distributors, and customers.

The innovation of attributional and conditional rebates: lessons from a tech giant

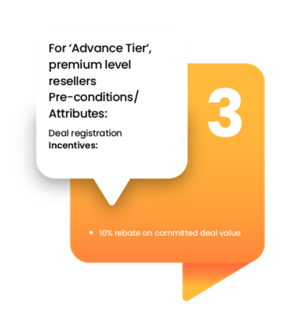

Isolated and unrelated rebates are passe. It is time to move to attributional and conditional rebates for targeted markets and enriched sales. As an example, training represents a critical attribution to higher sales. Sales efforts coupled with trained sales teams multiply revenue exponentially. An educated/trained arsenal of resellers and distributors ensures post-sales service in addition to driving sales numbers.

Another example is lead registration. Registration of leads supplemented with lead generation boosts deal closure rates.

One of the world’s largest tech companies enriches its sales by weaving these attributes into its incentives. The result? An exponential increase in sales and a highly trained sales force. Let’s see the attributional and conditional rebates with which it captured market share even without a ‘first mover’s advantage’.